Healthcare costs in South Africa are on the rise, making it more important than ever to choose the right cover for your needs. With medical aid premiums increasing by up to 12.75% in 2025, many South Africans are exploring more affordable health insurance options from providers like Day1 Health, Affinity Health, and Unity Health. But what’s the difference between medical aid and health insurance, and which one is right for you?

Understanding the Difference

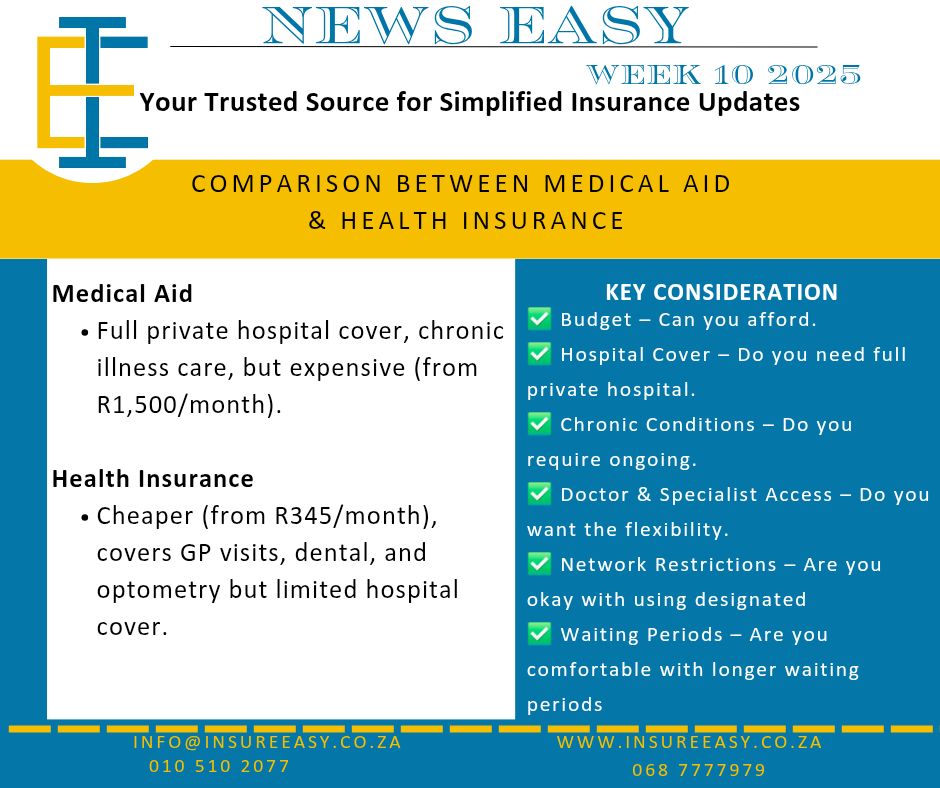

While both medical aid and health insurance help cover medical costs, they are not the same. Here’s a breakdown:

Medical Aid (e.g., Discovery, Bonitas, Fedhealth, etc.)

✔ Regulated under the Medical Schemes Act with comprehensive healthcare coverage.

✔ Covers private hospital stays, specialist visits, chronic conditions, and major medical expenses.

✔ Higher monthly premiums (starting from R1,500/month).

✔ Longer waiting periods (up to 12 months for pre-existing conditions).

✔ Covers most chronic medication.

Health Insurance (e.g., Day1 Health, Affinity Health, Unity Health, etc.)

✔ Regulated under insurance laws, but not part of medical schemes.

✔ Covers day-to-day healthcare like GP visits, dental, optometry, and pharmacy benefits.

✔ Limited hospital coverage—usually only for accidents and emergencies.

✔ More affordable (starting from R345/month).

✔ Shorter waiting periods (3–6 months for some benefits).

Which One is Right for You?

Before making a decision, consider these key factors:

1. Budget

Can you afford higher premiums for full private hospital cover, or do you need a cheaper option for basic care?

2. Hospital Cover

Do you want full private hospital access or just emergency and accident coverage?

3. Chronic Conditions

Do you need ongoing treatment for illnesses like diabetes or hypertension?

4. Doctor Choice

Do you want the freedom to visit any doctor, or are you okay using a network of approved providers?

5. Waiting Periods

Are you comfortable waiting up to 12 months for some medical aid benefits to apply?

6. Provider Network

Do you need a wide range of hospitals and specialists, or will a basic network of doctors work for you?

7. Medication Cover

Do you need chronic and specialist-prescribed medication, or just basic pharmacy coverage?

Final Thoughts

Choosing between medical aid and health insurance comes down to your budget, healthcare needs, and lifestyle. If you need full hospital cover and chronic care, medical aid is the best choice—if you can afford it. If you want affordable day-to-day cover with some emergency benefits, health insurance is a great alternative.

No matter what you choose, having some form of cover is always better than having none. Make the best decision for your health and finances today!

What’s your take? Drop a comment below and share your experience with medical aid or health insurance!