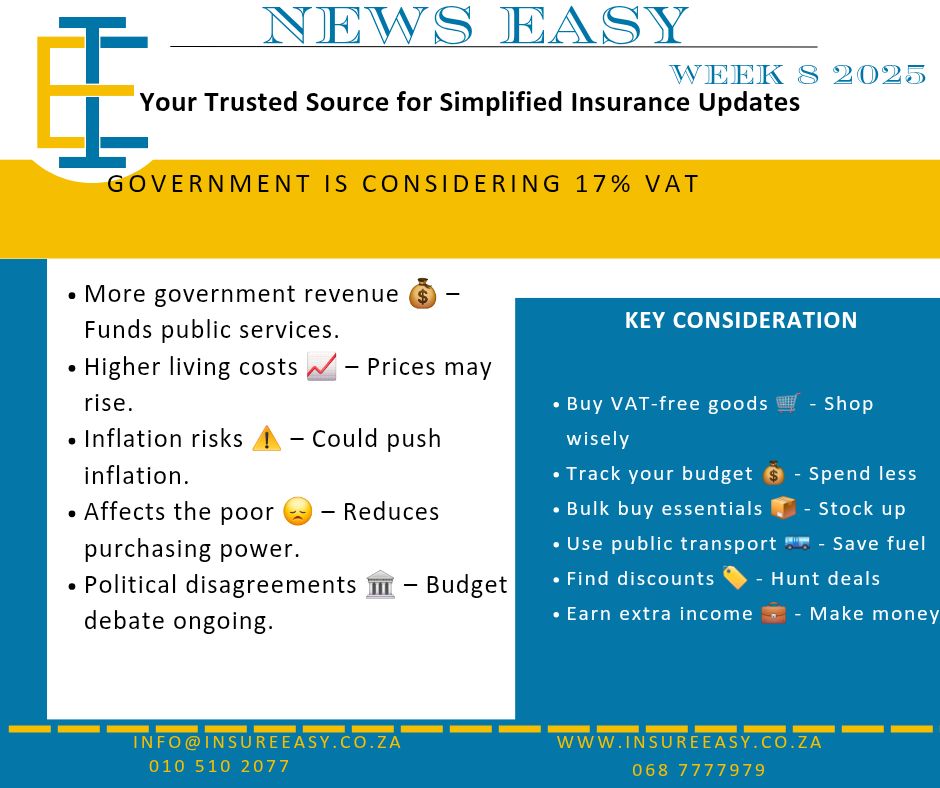

The government is considering raising VAT from 15% to 17% to address a budget shortfall and fund essential services. While this could boost government revenue, it may also increase the cost of living and put pressure on low-income households.

Why is the Government Considering a VAT Increase?

Increase Revenue – Expected to raise R22.3 billion for public services.

Address Budget Deficits – Helps stabilize government finances.

Fund Social Services – Supports social grants, education, and healthcare.

Respond to Economic Pressures – Rising global trade tensions impact revenue.

Political Disagreements – Some coalition partners oppose the increase.

How Will This Affect Consumers?

1. Higher Prices – Goods and services will cost more.

2. Inflation Risks – May push up inflation and interest rates.

3. Harder for Low-Income Households – Essentials become less affordable.

4. Impact on Businesses – Consumers may spend less, slowing growth.

5. Uncertainty – Decision expected in the March 12 Budget Speech.

How to Prepare

Buy VAT-free essentials like maize meal and vegetables.

Track your spending and cut unnecessary costs.

Bulk buy non-perishable goods before price hikes.

Use public transport to save on fuel.

Look for discounts and compare prices.

Find extra income through side jobs or small businesses.

The VAT increase is aimed at boosting government revenue, but it will affect consumers and businesses. Should the government find other ways to raise funds? Share your thoughts in the comments!