Private healthcare in South Africa is well-known for offering high-quality care, but the costs can be prohibitive, especially in cases of traumatic events like road accidents. However, without sufficient health insurance, the financial strain of private healthcare can become overwhelming.

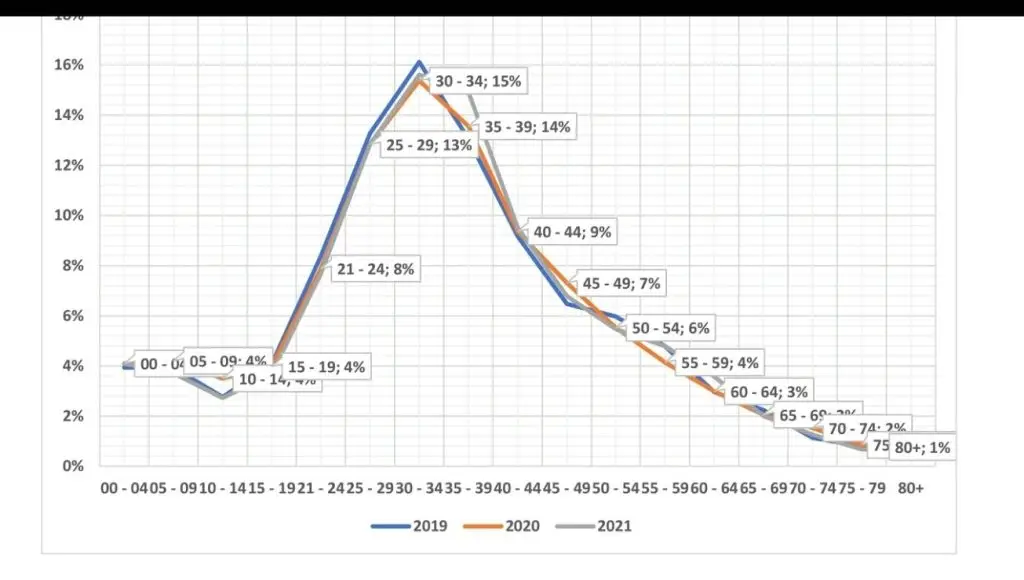

A large number of people that die from vehicle accidents are between 24 years to about 44 years. Some could be saved with a proper private health care.

Costs in private hospitals can vary greatly depending on the level of care needed:

General Ward: R2,500 to R4,000 per day

ICU (Intensive Care Unit): R10,000 to R30,000 per day

Specialist and treatment fees: R100,000 to R500,000 for severe trauma such as heart attacks or accidents

For instance, a patient involved in a serious car accident or stroke might require several days in the ICU followed by a longer stay in the general ward. This can push the total cost to R200,000 to R500,000 or even higher. Additionally, many hospitals require a guarantee of payment before admission, meaning you need to have the means to pay upfront.

The Reality of Traumatic Events: Accidents and Heart Attacks

In 2021, 10,611 fatal crashes resulted in 12,545 deaths, marking a 25.8% increase compared to 2020.

Around 120 people suffer heart attacks in South Africa daily, with treatment costs running into hundreds of thousands of rands.

Without proper health insurance, these costs can place a heavy burden on families already dealing with the stress of a medical emergency.

Health insurance is a vital tool for managing the high costs of private healthcare. Several affordable options are available, each providing financial support in different ways:

1. Health Insurance Products: These plans provide coverage for hospital admissions, critical illness treatment, and trauma care. They often offer lump-sum payouts or cover the direct medical expenses of major health incidents.

2. Hospital Cash Plans: These plans provide a daily cash benefit for each day you are hospitalized. This can help cover the costs that health insurance may not, such as additional specialist fees or post-hospitalization care.

Conclusion: Be Financially Prepared

Private healthcare in South Africa can offer some of the best medical care available, but it comes at a price. By securing health insurance or a hospital cash plan, you can protect yourself and your family from the financial strain of unexpected medical emergencies, ensuring that you receive the care you need without worrying about the costs.