But Pressure Still Felt at Household Level

Pretoria, 16 July 2025 – South Africa’s retail trade sales rose by 5.1% in May 2025 compared to the same month last year, according to Statistics South Africa (Statistical Release P6242.1). This marks a notable improvement from earlier in the year and reflects growing activity in the economy — particularly among general dealers (like supermarkets) and clothing and footwear retailers.

General dealers contributed 2.3 percentage points to the overall annual growth, while clothing, footwear and leather goods added 2.1 percentage points, supported by a year-on-year surge of 12.5% in that category.

The total value of retail trade sales (at constant 2019 prices) reached R102.1 billion in May 2025, up from R97.2 billion in May 2024.

Quarter-by-Quarter Signs of Strain

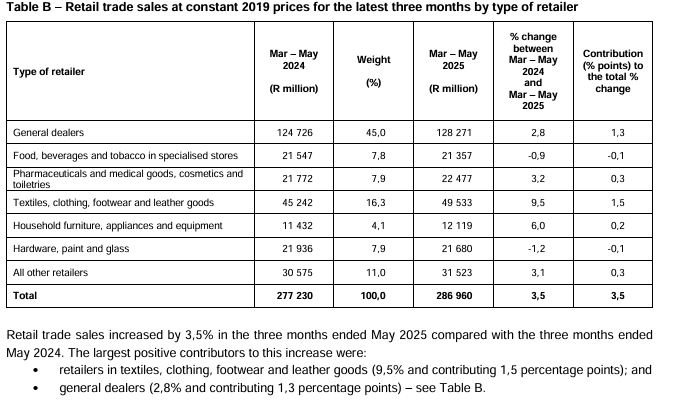

While the year-on-year growth is encouraging, quarterly data reveals a different picture. Retail sales for the three months ending May 2025 were up 3.4% compared to the same period in 2024, but seasonally adjusted sales fell by 0.5% compared to the previous quarter (Dec 2024 – Feb 2025).

This suggests that while consumers are spending more than a year ago, many households are still under pressure from high living costs, rising interest rates, and limited disposable income.

Insurance Perspective: What This Means for Households

These trends point to a mass-market consumer who is careful, needs-focused, and budget-conscious. The increased spending on basics like food and clothing may indicate stability in core household spending, but also shows that larger financial decisions — such as insurance or savings products — may be postponed unless they are seen as urgent or directly beneficial.

From an insurance policyholder’s viewpoint, this environment reinforces the need for predictable costs, clear value, and ease of access to financial protection, especially as unexpected life events remain a real risk.

Summary of Key Figures – May 2025

| Indicator | Value / Change |

|---|---|

| Year-on-year retail growth | +5.1% |

| Retail sales value (constant prices) | R102.1 billion |

| Monthly change (April to May 2025) | +0.9% (seasonally adjusted) |

| Quarterly change (Mar–May vs Dec–Feb) | −0.5% (seasonally adjusted) |

| Leading contributor: Clothing & Footwear | +12.5% (YoY) |

Final Note

The Stats SA data offers a mixed picture: confidence is growing slowly, but caution remains. For service providers and policymakers, this is a reminder that financial inclusion strategies must match the realities of constrained household budgets — especially when engaging the mass market on products like insurance, savings, or credit.