South Africa’s formal sector reported a R57.1 billion increase in gross earnings in the first quarter, according to Statistics South Africa’s latest Quarterly Employment Statistics (QES) release. On paper, this seems like a welcome recovery — a sign of rising pay, bonuses, and more hours worked.

Yet across the country, households are still tightening belts. So where is the disconnect?

Not All Incomes Are Created Equal

A closer look at the data reveals that the bulk of this increase stems from irregular earnings such as bonuses and overtime, rather than permanent salary adjustments. These are not guaranteed — and for millions, they’re not even accessible.

Workers in lower-paid roles often don’t benefit from bonuses. Meanwhile, industries such as construction, trade, and manufacturing reported job losses, meaning fewer people are sharing in these gains.

“A few earn more, while many still earn nothing at all. That creates an illusion of growth,” said a Soweto-based labour analyst.

Urban vs. Rural Divide Deepens

Stats SA’s data does not break down the R57 billion increase by region, but economists warn the gains are heavily concentrated in metro areas, particularly in financial services and government-linked sectors.

This mirrors long-standing trends where rural areas lag behind, and even a national increase in earnings does little to shift deep-seated inequalities in provinces like Limpopo, Eastern Cape, or North West.

Job Losses in Strategic Sectors

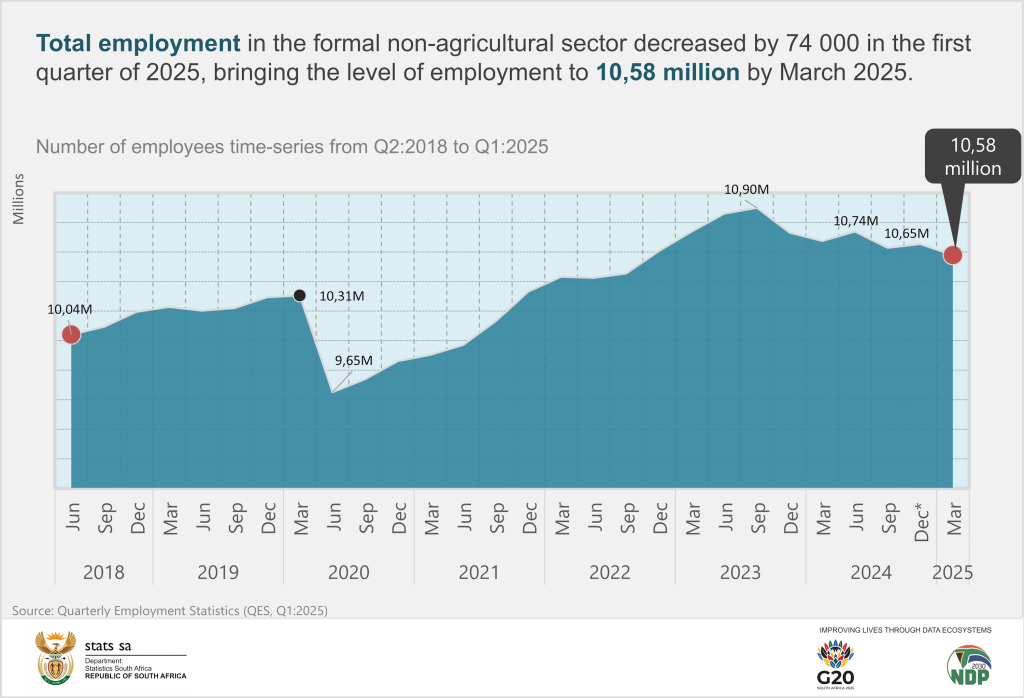

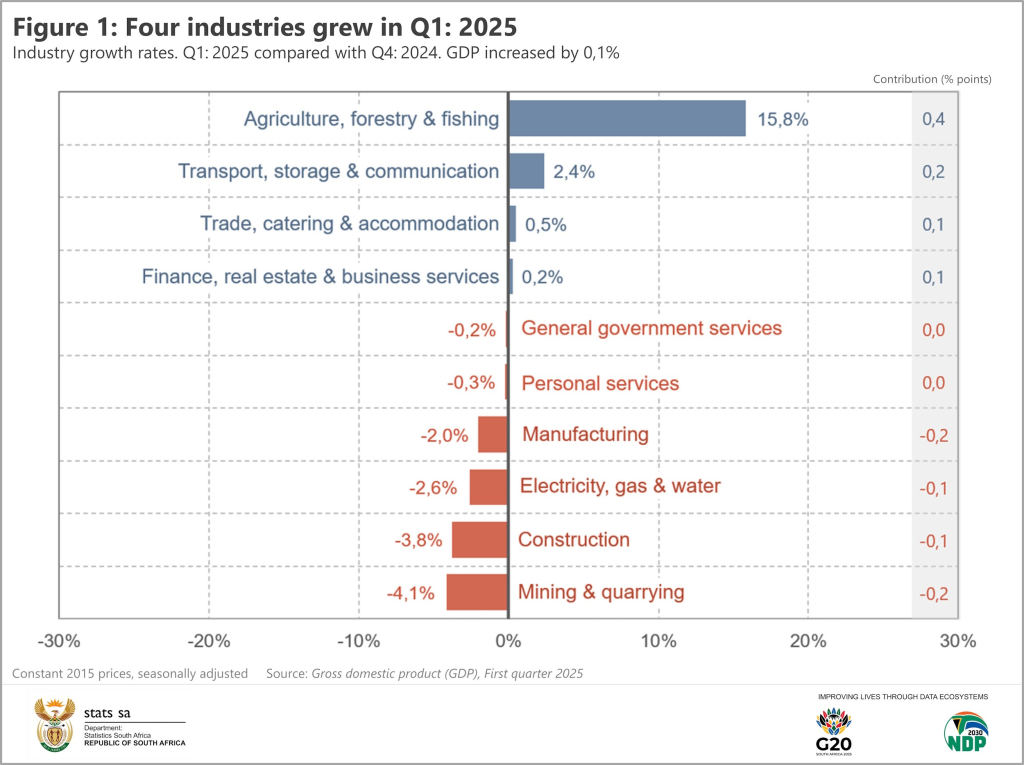

Despite the overall increase in earnings, the economy shed 67,000 jobs in the same period. Most notably:

- Construction: down 14,000 jobs

- Trade: down 11,000 jobs

- Transport: down 3,000 jobs

These sectors are essential for middle- and lower-income employment and are critical in delivering infrastructure and goods. Their decline signals fragile demand and sluggish economic momentum despite headline earnings growth.

Wage Growth May Mask Productivity Issues

While earnings rose, labour productivity — how much is produced per hour worked — remains a concern. A large portion of wage increases may be absorbing rising inflation or compensating for long working hours, rather than reflecting genuine productivity improvements.

This means businesses are paying more without necessarily producing more, a sign of stress in the economy that may not be sustainable

What the Numbers Don’t Say

Temporary gains can’t drive long-term security: Bonuses and overtime inflate numbers but don’t build lasting wealth.

Job quality matters more than raw numbers: The loss of permanent jobs in construction and trade weakens household resilience.

Without savings and protection, gains are exposed: Many households remain one funeral, accident, or illness away from financial ruin.