Market Growth and Projections

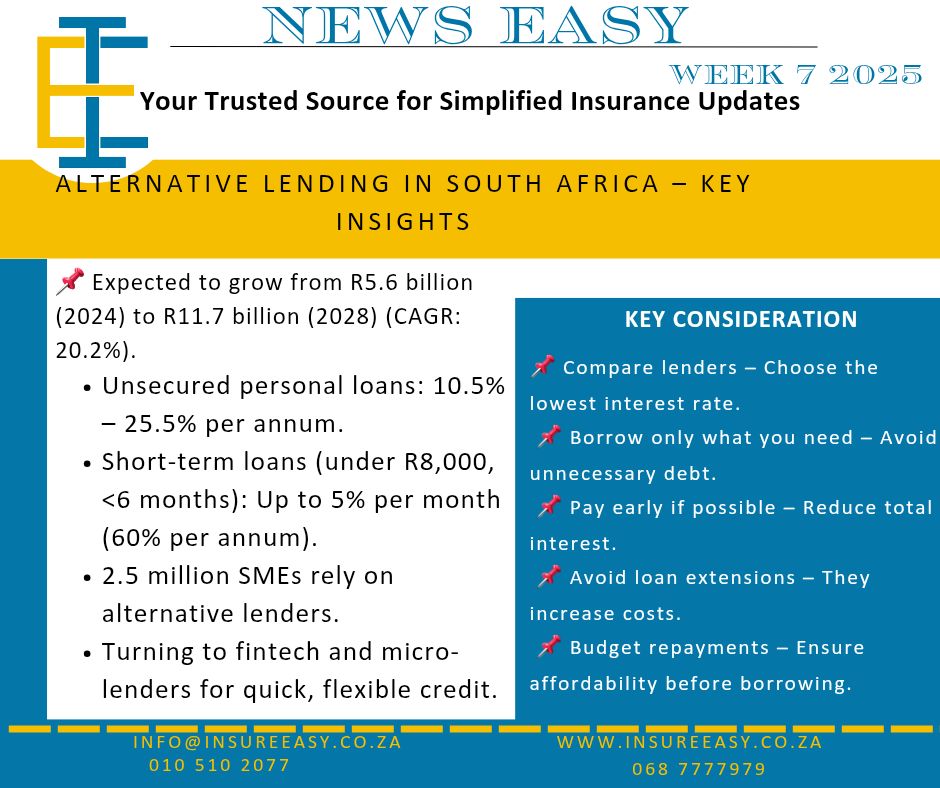

- Robust Expansion: In 2024, the alternative lending sector in South Africa is projected to grow by 29.5%, reaching approximately R5.6 billion. This upward trajectory is expected to continue, with the market estimated to double to R11.7 billion by 2028, reflecting a compound annual growth rate (CAGR) of 20.2%.

- Platform Revenue Increase: Alternative lending platforms generated R1.1 billion in revenue in 2024, with expectations to reach R4.3 billion by 2030, indicating a CAGR of 25.5% from 2025 to 2030.

Key Drivers

- Technological Innovation: Fintech companies are leveraging mobile technology and alternative data sources to provide credit access to underserved individuals and businesses, enhancing financial inclusion.

- Regulatory Support: Progressive regulatory changes aim to enhance transparency and consumer protection, fostering a conducive environment for alternative lending growth.

Notable Developments

- Strategic Investments: In December 2024, Brazilian digital bank Nubank invested $150 million in South Africa’s Tyme Group, elevating Tyme to a unicorn status with a valuation of $1.5 billion. This investment supports Tyme’s expansion into Southeast Asia and underscores the growing confidence in South Africa’s fintech landscape.

- Market Diversification: The alternative finance market has introduced flexible, tailor-made solutions for businesses, especially in the retail sector, reducing reliance on traditional banking systems.

Challenges and Considerations

- Regulatory Compliance: Adhering to the National Credit Act and interest rate caps is essential to avoid legal challenges and maintain consumer trust.

- Risk Management: Implementing robust credit assessment and fraud detection mechanisms is crucial to mitigate high default rates.

In summary, South Africa’s alternative lending market is poised for continued growth, driven by technological innovation, strategic investments, and supportive regulatory frameworks. As the sector evolves, it offers promising opportunities for financial inclusion and economic development.