In South Africa, over 60% of vehicles on the road are uninsured, leaving millions vulnerable to financial loss. Vehicle insurance is more than just a financial product—it’s a safety net that can save you from devastating costs after accidents, theft, or unforeseen events.

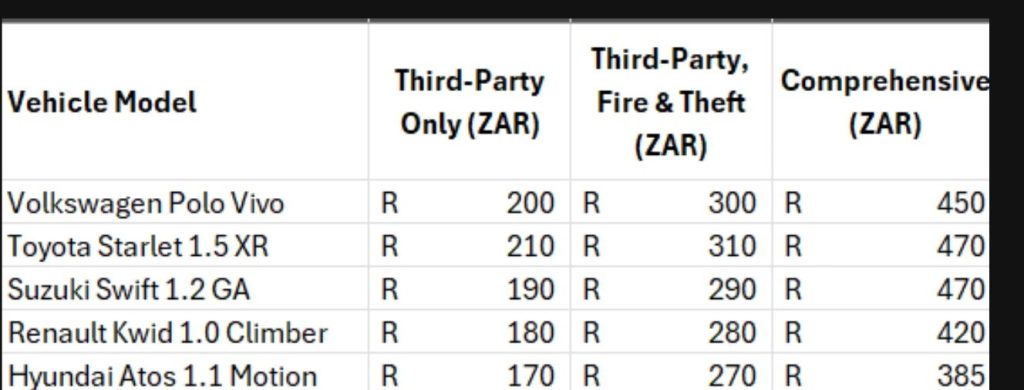

The table below aims to illustrate price differences between different types of vehicle insurance.

Choosing not to insure your vehicle may seem like a cost-saving decision, but the financial and personal risks are immense:

1. Financial Risk of Accidents

If you’re involved in an accident and at fault, you’re liable to pay for damages to the other driver’s vehicle, as well as any injuries or property damage.

2. Theft or Total Loss

Vehicle theft is a significant issue in South Africa. If your car is stolen or written off in an accident, you’ll lose your primary mode of transport

3. Legal Liability

Third-party liability is a legal requirement in many cases. If you cause an accident that damages another vehicle or injures someone, you may face lawsuits or legal penalties if you’re uninsured.

4. Higher Out-of-Pocket Expenses

Without insurance, even minor accidents can result in repair bills that could exceed your budget. For example, repairing a bumper can cost R10,000 or more, depending on your vehicle’s make and

Conclusion

While the upfront cost of insurance might seem like an additional burden, the consequences of not insuring your vehicle are far more severe. Whether it’s safeguarding against accidents, theft, or liability claims, vehicle insurance is a non-negotiable aspect of financial planning for South African drivers.

Remember, a small monthly premium can prevent a lifetime of financial stress.