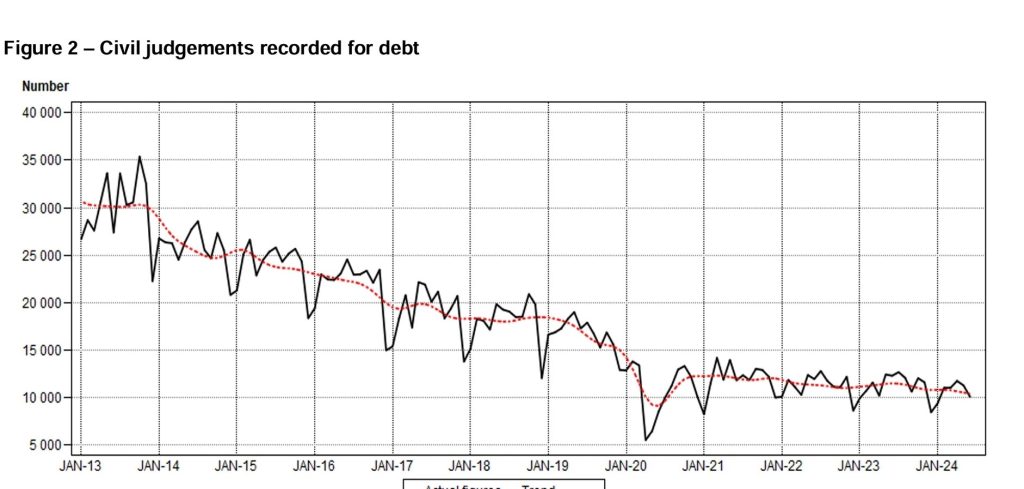

Recent data from Statistics South Africa shows a significant decrease in debt-related civil summonses and judgements in the second quarter of 2024. The number of civil summonses issued dropped by 10.9%, with promissory notes, money lent, rent, and goods sold being the main contributors to this decline. Civil judgements for debt also fell by 5.3%, largely due to reductions in money lent and other debts.

These trends underscore the importance of financial protection for South Africans. With the challenges in debt recovery, now is the time for individuals and businesses to consider strengthening their financial security through comprehensive insurance coverage. By investing in insurance, South Africans can safeguard themselves against unforeseen financial hardships, ensuring stability in uncertain times.